Worthwhile

Quick, user-friendly options available globally. Just one document to start

Quick, user-friendly options available globally. Just one document to start

A reliable direct lender with fresh solutions. We protect your information and assist during challenging times

Simple home-based solutions quickly. Funds transferred immediately with flexible loan durations

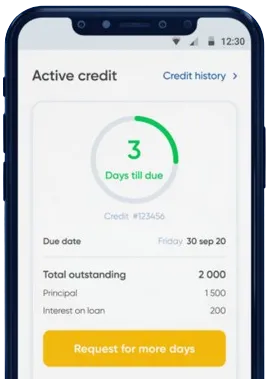

Enter your application details in the app by filling out the form.

Wait for our quick decision, which takes only 15 minutes.

Accept your funds, normally transferred in about one minute.

Enter your application details in the app by filling out the form.

Download loan app

Instant payday loans are a popular financial solution for many South Africans who find themselves in need of quick cash. These short-term loans provide borrowers with instant access to funds, typically within 24 hours of approval. While payday loans have received some criticism for their high interest rates, they can be a valuable resource for those facing unexpected expenses or emergencies.

One of the main benefits of instant payday loans is their speed and convenience. Unlike traditional bank loans, which can take weeks to process, payday loans are typically approved within hours. This can be crucial for those facing urgent financial needs, such as medical bills or car repairs.

Another benefit of payday loans is their accessibility. Many traditional lenders require a high credit score or collateral to secure a loan, making it difficult for some borrowers to qualify. Payday loans, on the other hand, are often available to those with less-than-perfect credit and do not require collateral.

Despite their high interest rates, payday loans can be a useful option for those who need immediate financial assistance and do not have access to traditional banking services.

Instant payday loans can be especially useful in situations where traditional financing is not an option. For example, if a borrower needs to cover unexpected medical expenses or repair a crucial household appliance, a payday loan can provide the necessary funds quickly and without the red tape of traditional lenders.

Additionally, payday loans can help smooth out the peaks and valleys of irregular income. For those who work on a freelance basis or have fluctuating paychecks, payday loans can provide a way to cover expenses during leaner months.

Overall, instant payday loans can serve as a helpful financial tool for those in need of quick cash and can provide a valuable lifeline in times of financial distress.

Before applying for an instant payday loan, borrowers should carefully consider their financial situation and ability to repay the loan. While payday loans can be a helpful resource, they should not be used as a long-term solution to financial problems. Borrowers should also be aware of the high interest rates associated with payday loans and only borrow what they can afford to repay.

Instant payday loans in South Africa can be a valuable resource for those in need of quick cash, offering speed, accessibility, and convenience. While payday loans should be used responsibly and with caution, they can provide a lifeline in times of financial distress. By weighing the benefits and drawbacks of payday loans and understanding the terms and conditions, borrowers can make informed decisions about their financial future.

An instant payday loan is a type of short-term loan that is typically repaid on the borrower's next payday. It is designed to provide quick access to funds for individuals who need money urgently.

To apply for an instant payday loan, you typically fill out an online application form with details such as your income, employment status, and banking information. Once approved, the funds are usually deposited into your bank account within a few hours or the next business day.

Common requirements include being a South African resident, over 18 years of age, employed with a regular income, and having an active bank account. Lenders may have additional criteria, so it's best to check with them directly.

Interest rates and fees for instant payday loans in South Africa can vary depending on the lender and the amount borrowed. It's important to carefully read the terms and conditions before agreeing to a loan to understand the total cost of borrowing.

The amount you can borrow with an instant payday loan in South Africa typically ranges from R500 to R8,000, but this may vary depending on the lender and your individual financial situation.

If you are unable to repay your instant payday loan on time, you may incur additional fees and interest charges. It's important to communicate with your lender as soon as possible to discuss repayment options and avoid further financial difficulties.